2020 CST payments are nontaxable

CIRI shareholders approved the creation of the CIRI Settlement Trust (CST) in June 2019. Thereafter, CIRI’s Board of Directors rescinded CIRI’s dividend policy in favor of contributing amounts that CIRI would have issued as quarterly dividends to the CST Distribution Fund, with the CST trustees agreeing to distribute the contributed amounts to CST beneficiaries who are CIRI shareholders. Beginning in 2020, the CIRI Board also authorized CIRI to contribute amounts to permit the CST Elders Fund to distribute $450 to qualified Elders on a quarterly basis. The quarterly payments issued in 2020 from the CST Distribution Fund and the CST Elders Fund are nontaxable; thus, tax forms will not be issued and the payments will not be reported to the Internal Revenue Service.

Tax status of 2020 CIRI payments

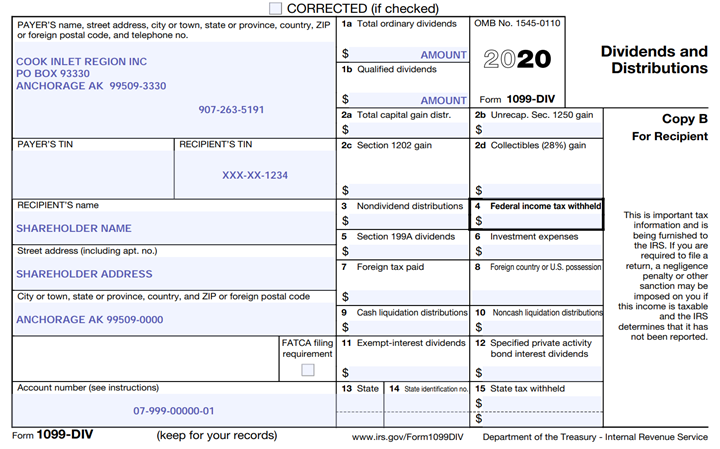

CIRI IRS Forms 1099 for the 2020 tax year will be mailed no later than February 1, 2021. Shareholders with portal accounts will be able to access their 1099s at qenek.ciri.com before the forms are mailed, with an email sent to advise when the forms are available. Tax information remains accessible in Qenek for seven years, allowing shareholders to easily view and print their forms, if desired.

2020 tax forms will reflect all payments made to affected CIRI shareholders in 2020, and such shareholders may receive more than one type of Form 1099 depending on type of CIRI income received. These include:

- Form 1099-DIV (estate payments). If you inherited CIRI shares in 2020, any held dividends paid by CIRI in connection with the inherited shares will be reported in Boxes 1a – Ordinary Dividends and 1b – Qualified Dividends on Form 1099-DIV. If you have held your shares for less than one year, please consult your tax advisor regarding the proper treatment of qualified dividends.

- Form 1099-MISC (resource revenue payments, prizes, SPC fees). Resource revenue—or 7(j)— payments derive from resource revenue sharing obligations among the 12 Alaska Native regional corporations, as required by the Alaska Native Claims Settlement Act (ANCSA). Shareholders who owned at-large stock on March 24, 2020, received an $18.8951 per at-large share (or $1,889.51 per 100 shares) 7(j) payment from CIRI in 2020. Additionally, if you inherited at-large stock in 2020 and received an estate settlement payment, a portion of that payment may have consisted of held 7(j) funds. Resource revenue payments are not dividends, and are not considered investment income, and are reported in Box 3 – Other Income on a Form 1099-MISC. ANCSA requires that resource revenue amounts distributed in connection with CIRI village-class stock be paid to the associated village; therefore, CIRI does not report these payments as individual shareholder income. Shareholder prizes and fees paid to Shareholder Participation Committee members during the tax year are also reported in Box 3 – Other Income on a Form 1099-MISC.

Please note that it is your responsibility to accurately report your CIRI income on your tax returns; CIRI cannot provide tax advice. The proper IRS forms and schedules to use when completing individual tax returns may vary depending on the types of CIRI payments received. Shareholders are encouraged to consult with a tax advisor regarding individual circumstances and applicable federal and state tax requirements.