CIRI Settlement Trust (CST) Distribution

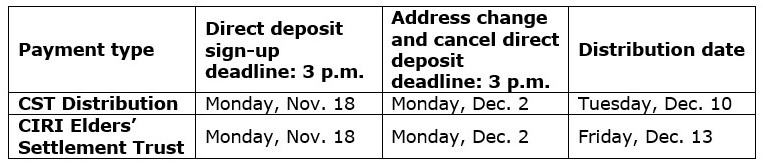

Fourth quarter CST distributions in the amount of $10.51 per share (or $1,051 per 100 shares) will be mailed or directly deposited by 6 p.m. Alaska Standard Time on Tuesday, Dec. 10 to all CST beneficiaries who own CIRI stock and have a valid mailing address on file with CIRI as of 3 p.m. Monday, Dec. 2.

Elders’ Settlement Trust Distribution

Fourth quarter CIRI Elders’ Settlement Trust distributions of $450 will be mailed or directly deposited by 6 p.m. Alaska Standard Time on Friday, Dec. 13 to eligible Elders with a valid mailing address on file as of 3 p.m. Monday, Dec. 2. Original shareholders who are 65 years of age or older and who own at least one share of CIRI stock as of the distribution date are eligible to receive the $450 payments.

As previously reported, CIRI Elders’ Settlement Trust funding ran out in 2019, with the CIRI Board of Directors approving providing the necessary funding to cover the shortfall and ensure all eligible Elders receive full payments through the end of the year. Beginning in 2020, Elders’ benefits will be provided through the CST—which was established by a majority vote of the shareholders at the 2019 Annual Meeting—maintaining the current level of payments and eligibility requirements of the CIRI Elders’ Settlement Trust.

Direct/Remote Deposit

CIRI urges shareholders who receive their distributions in check form to consider either implementing direct deposit or taking advantage of remote deposit. Both options are fast, easy and eliminate the need to drive to the bank and stand in line. (Note: When remotely depositing a check, it’s a good idea to make a note on the check so you don’t attempt to cash it again. If a check is cashed twice, you are legally liable to repay the amount of the overpayment.)

Shareholders who participate in direct deposit and have a current CIRI mailing address are also eligible to participate in quarterly prize drawings.

Direct deposit forms are available from Shareholder Relations and at ciri.com. To cancel direct deposit, please submit a signed, written request prior to 3 p.m. on the specified deadline. If you have a Qenek portal account, you can cancel your existing direct deposit instruction online via the portal.

Address Changes

Checks and vouchers are mailed to the address CIRI has on record as of the specified deadline. If your address has changed, be sure to update your address with both CIRI and the U.S. Postal Service. These addresses must match or your CIRI mail may not reach you. When CIRI mail is undeliverable, distributions are held and the shareholder does not qualify to participate in any prize drawings until the address is updated. This is true even if a shareholder is signed up for direct deposit.

CIRI address changes may be submitted online via the Qenek portal. Alternatively, you may submit a completed CIRI address change form – available at ciri.com – or a signed, written request that includes a current telephone number. Address change forms and requests can be scanned and emailed to shareholderrecords@ciri.com, mailed to CIRI at PO Box 93330, Anchorage, AK 99509, or faxed to (907) 263-5186. If faxed, please call Shareholder Relations as soon as possible to confirm receipt. Forms and information on changing your address or submitting a mail-forwarding request with the U.S. Postal Service are available at www.usps.com or your local post office.

Please be aware that if you fail to notify CIRI of a new address before a specified deadline and your check is sent to your old address, CIRI cannot reissue that check to you unless it is either returned to us, or a minimum of 90 days has elapsed. A list of shareholders who do not have a current mailing address on record is continually updated and may be found on the CIRI website.

Tax Reminder

Neither CIRI nor the CST withhold taxes from distributions; however, shareholders or beneficiaries who anticipate owing tax on their distributions have the option of making quarterly estimated tax payments directly to the IRS. To find out more about applicable federal and state tax requirements or making quarterly estimated tax payments, please consult with a tax advisor or contact the IRS directly.

As a reminder, distributions made by the CST are expected to be tax-free to beneficiaries in most cases.