Understanding CIRI’s financial statements

CIRI recently released its 2014 Annual Report. This document summarizes the company’s performance last year and contains information that shareholders and interested readers can use to better understand CIRI’s business and investments. Annual report financial statements can be difficult to understand. This guide explains key parts of the financial statements that are on pages 25-29 of CIRI’s 2014 Annual Report.

CIRI recently released its 2014 Annual Report. This document summarizes the company’s performance last year and contains information that shareholders and interested readers can use to better understand CIRI’s business and investments. Annual report financial statements can be difficult to understand. This guide explains key parts of the financial statements that are on pages 25-29 of CIRI’s 2014 Annual Report.

The consolidated financial statements include:

- Consolidated Balance Sheets

- Consolidated Statements of Income

- The Consolidated Statements of Changes in Shareholders’ Equity

- Consolidated Statements of Cash Flows

The consolidated financial statements are accompanied by footnotes that provide additional details about the company’s financial position, investments and earnings. An independent auditor, KPMG LLP, audits the financial statements and issues opinions as to CIRI’s conformity with generally accepted accounting principles. Following the financial statements and footnotes is CIRI Management’s Discussion and Analysis that provides additional information about the company’s operations and holdings.

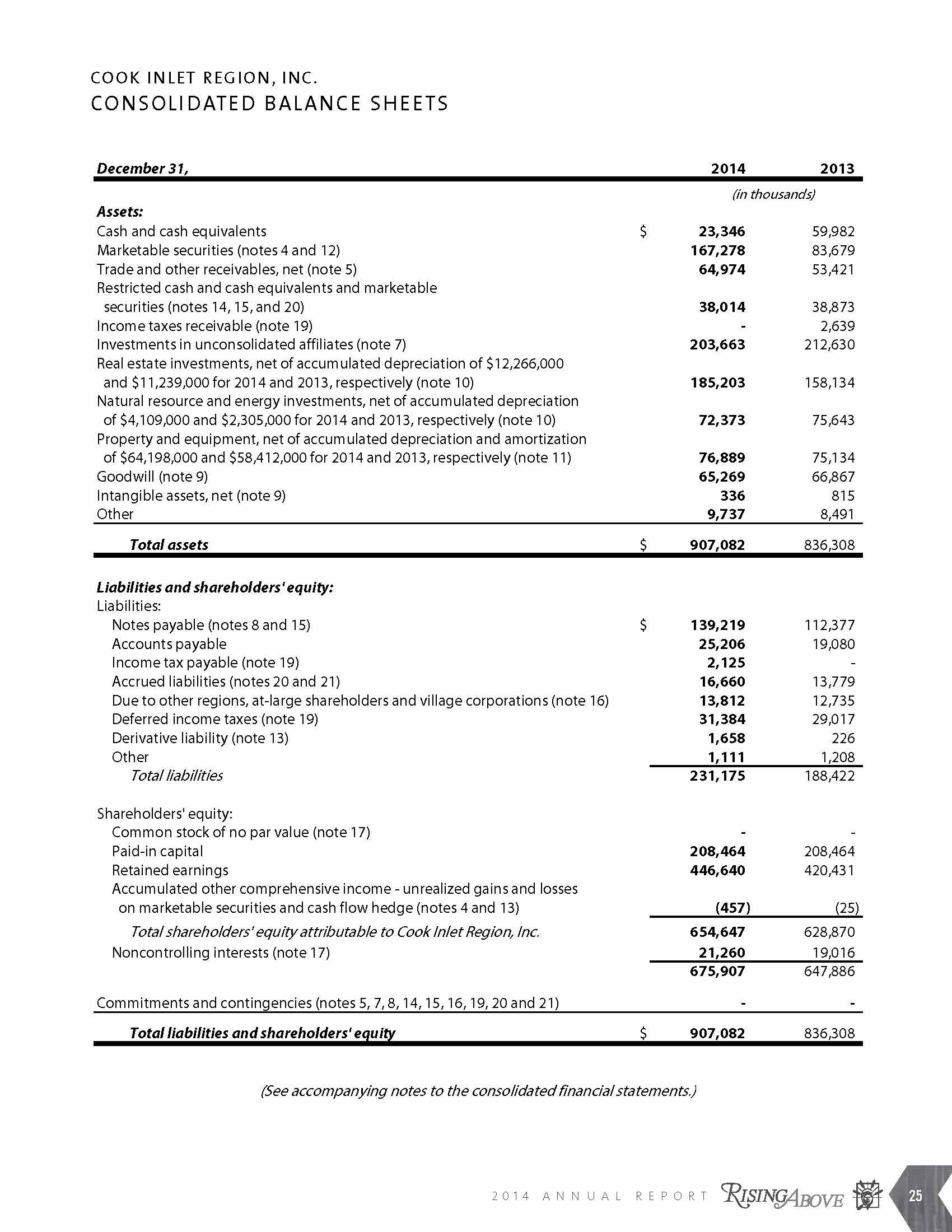

Consolidated Balance Sheets

Consolidated Balance Sheets

- Assets: What the company owns and what is owed to it.

- Liabilities: What the company owes.

- Shareholders’ equity: The net worth of the company, which is equal to company assets minus company liabilities.

- Cash and cash equivalents and marketable securities: Cash in bank accounts, money market accounts, equities and bonds that can easily be converted into cash.

- Restricted cash and cash equivalents and marketable securities: Cash and marketable securities the company has set aside to pay future liabilities.

- Investments in unconsolidated affiliates: CIRI’s ownership interests in other corporations, partnerships, limited liability companies and joint ventures in which CIRI does not hold a controlling interest.

- Natural resource and energy investments: Land and resource property and energy investments, including the Fire Island Wind project.

- Liabilities: Amounts owed by CIRI from debt or costs unpaid at year-end.

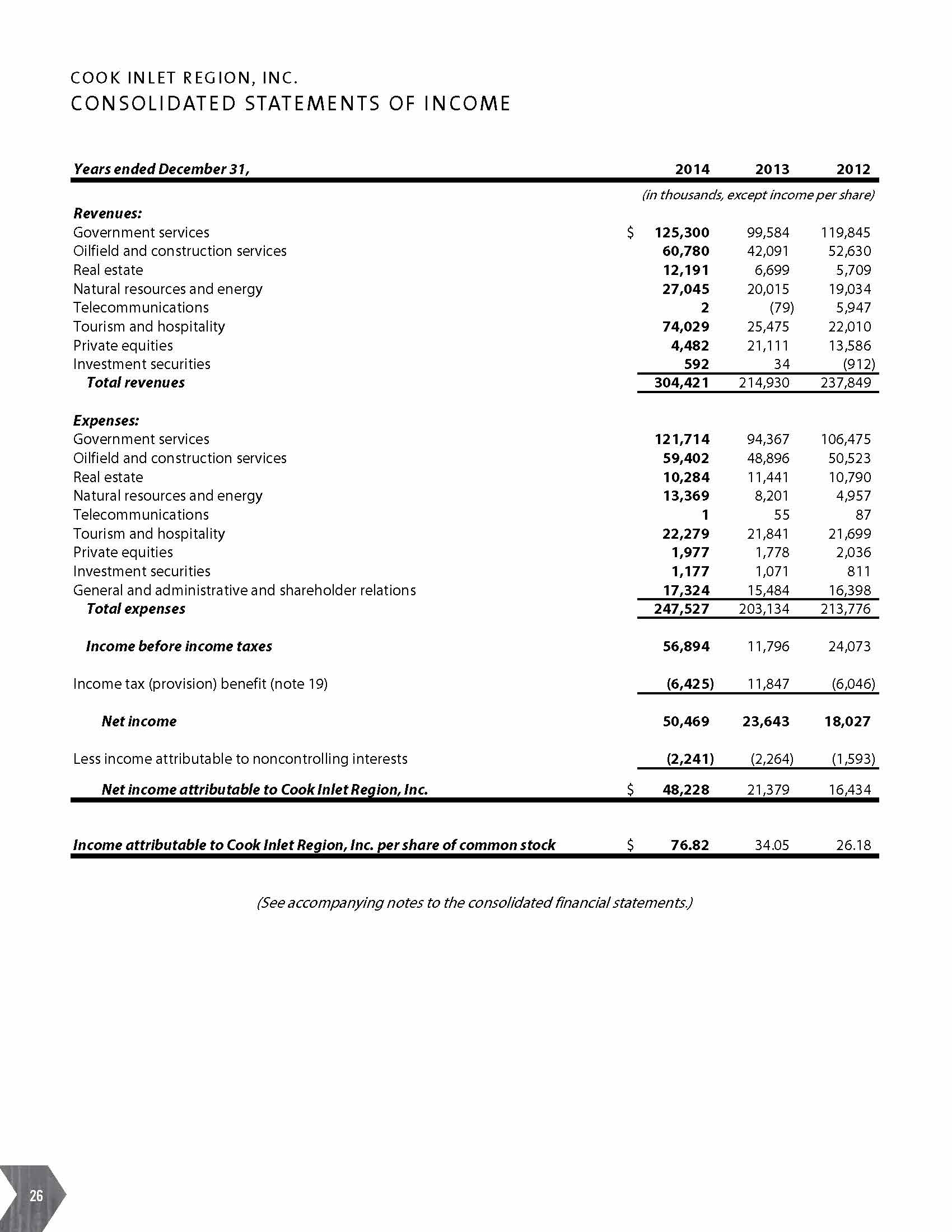

Consolidated Income

Consolidated Income

CIRI’s revenues and expenses are reported by operating segment:

- Government services income includes CIRI’s operations that provide services to local, state and federal government agencies.

- Oilfield and constructions services income is CIRI’s share of net earnings from its revenues from oilfield operations services and heavy marine hauling and construction support.

- Real estate income includes property leases, property management fees and brokerage commissions and CIRI’s interests in multi-family and retail investments as well as revenues from the sale of real estate holdings.

- Natural resources and energy income is from oil and gas royalty revenues, 7(i) resource sharing payments received from other ANCSA corporations and investments in wind farms.

- Telecommunications income was from CIRI’s previous ownership interest in a joint venture with T-Mobile.

- Tourism income is from CIRI’s Alaska Tourism Company and CIRI’s interests in an out-of-state resort and hotel.

- Private equities income is from investments in general private equity and venture capital funds that invest in a broad variety of industries, both foreign and domestic.

- Income per share of common stock divides the net income by the number of outstanding CIRI shares (627,800), to report the amount of income earned per share.

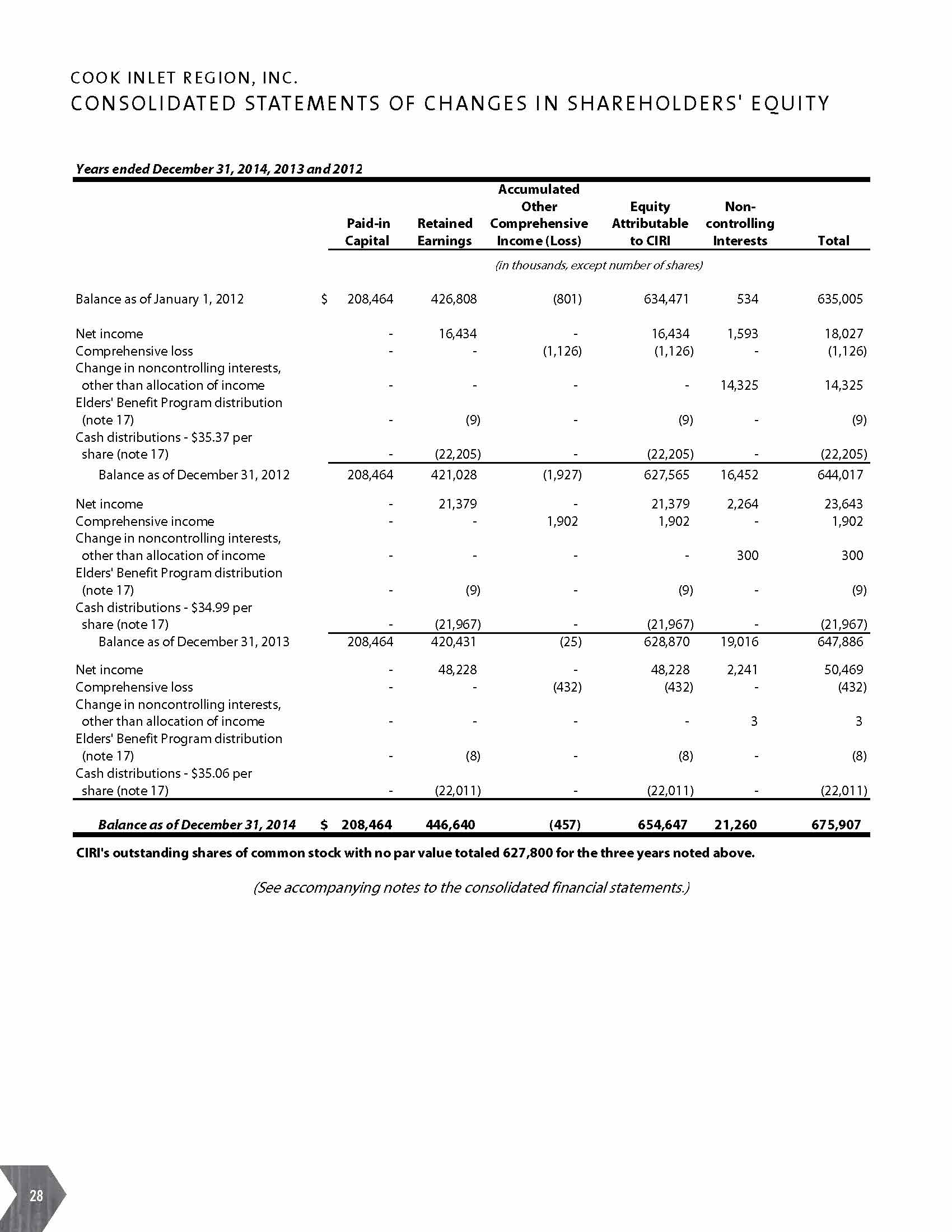

The Consolidated Statements of Changes in Shareholders’ Equity

The Consolidated Statements of Changes in Shareholders’ Equity

This financial statement shows the year’s activity in each of the components of shareholders’ equity including current year net income and dividends paid to shareholders.

- Net income as reported in the statements of operations.

- Total dividends paid to shareholders during 2014.

Consolidated Statements of Cash Flows

This statement shows how CIRI used or received cash during the year.

- CIRI generated $70.3 million from its operations in 2014.[lightbox link=”https://www.ciri.com/wp-content/uploads/2015/04/Annual-Report-Consolidated-Cash-Flow.jpg” thumb=”https://www.ciri.com/wp-content/uploads/2015/04/Annual-Report-Consolidated-Cash-Flow-232×300.jpg” width=”232″ align=”right” title=”Annual Report – Consolidated Cash Flow” frame=”true” icon=”image” caption=””]

- CIRI received a net $110.9 million in 2014 from a variety of operating companies, interests in

partnerships and marketable securities. - CIRI paid $22.0 million in shareholder dividends in 2014.

Glossary of Financial Terms

Asset: Something of value that is owned, including cash and items that are convertible to cash. Examples of assets include receivables (monies owed to the company), inventories (supplies), property and equipment (buildings, land, machinery, etc.).

Consolidated Statements of Operations: These reports show the combined revenues, expenses and net income or net loss of a company.

Consolidated Statement of other Comprehensive Income: These reports show non-cash gains (or losses) not recognized in the Statements of Operations.

Expenses: The costs required to generate revenue. For example, fuel to operate construction equipment.

Fiscal year: CIRI’s fiscal year is Jan. 1 through Dec. 31.

Liability: A company’s legal debt or obligation that arises during the course of business operations.

Liquidity: Cash and current assets sufficient to satisfy a company’s liabilities and commitments as they come due.

Marketable securities: A general term for stocks, bonds or other investments that can be sold on the open market.

Net income: When total revenues exceed total expenses.

Net loss: When total expenses exceed total revenues.

Revenue: The money received from operating a business or earned from holding an asset.

Total shareholders’ equity: Total assets minus total liabilities.